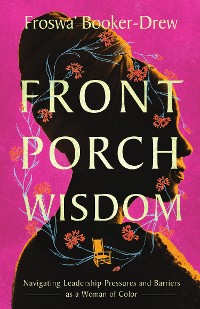

The Code of Capital

Katharina Pistor

* Affiliatelinks/Werbelinks

Links auf reinlesen.de sind sogenannte Affiliate-Links. Wenn du auf so einen Affiliate-Link klickst und über diesen Link einkaufst, bekommt reinlesen.de von dem betreffenden Online-Shop oder Anbieter eine Provision. Für dich verändert sich der Preis nicht.

Sozialwissenschaften, Recht, Wirtschaft / Wirtschaft

Beschreibung

A compelling explanation of how the law shapes the distribution of wealth

Capital is the defining feature of modern economies, yet most people have no idea where it actually comes from. What is it, exactly, that transforms mere wealth into an asset that automatically creates more wealth? The Code of Capital explains how capital is created behind closed doors in the offices of private attorneys, and why this little-known fact is one of the biggest reasons for the widening wealth gap between the holders of capital and everybody else.

In this revealing book, Katharina Pistor argues that the law selectively “codes” certain assets, endowing them with the capacity to protect and produce private wealth. With the right legal coding, any object, claim, or idea can be turned into capital—and lawyers are the keepers of the code. Pistor describes how they pick and choose among different legal systems and legal devices for the ones that best serve their clients’ needs, and how techniques that were first perfected centuries ago to code landholdings as capital are being used today to code stocks, bonds, ideas, and even expectations—assets that exist only in law.

A powerful new way of thinking about one of the most pernicious problems of our time, The Code of Capital explores the different ways that debt, complex financial products, and other assets are coded to give financial advantage to their holders. This provocative book paints a troubling portrait of the pervasive global nature of the code, the people who shape it, and the governments that enforce it.

Kundenbewertungen

Asset, Trade secret, Employment, Securitization, Funding, Law enforcement, Governance, Central bank, Financial intermediary, Rule of law, Wealth, Jurisdiction, Credit derivative, By-law, Plaintiff, Bankruptcy, Insurance, Law school, Corporate law, Capitalism, Financial crisis, Investor, Long-Term Capital Management, Private law, English law, Property law, Attempt, Regulatory competition, Protectionism, Corporation, State law (United States), Patent, Subsidiary, Law firm, Trust law, Goldman Sachs, Right to property, Capital asset, Contract, Know-how, Arbitration, Debt, Lehman Brothers, Unsecured creditor, Behalf, Legal profession, Priority right, Payment, Tax, Dividend, Statute, Debtor, Economist, Insolvency, Financial asset, Class action, Court, Barriers to entry, Lawyer, Self-governance, Intellectual property, Legal code (municipal), Guarantee, Statutory law, Mortgage loan, Blockchain, Treaty, Shareholder, Creditor, Income